TokenEconomist

Recently, a significant piece of news has emerged: China and the United States have agreed to suspend tariff increases for 90 days. This decision undoubtedly brings a glimmer of hope to the global economic situation, avoiding direct confrontation between the two major economies.

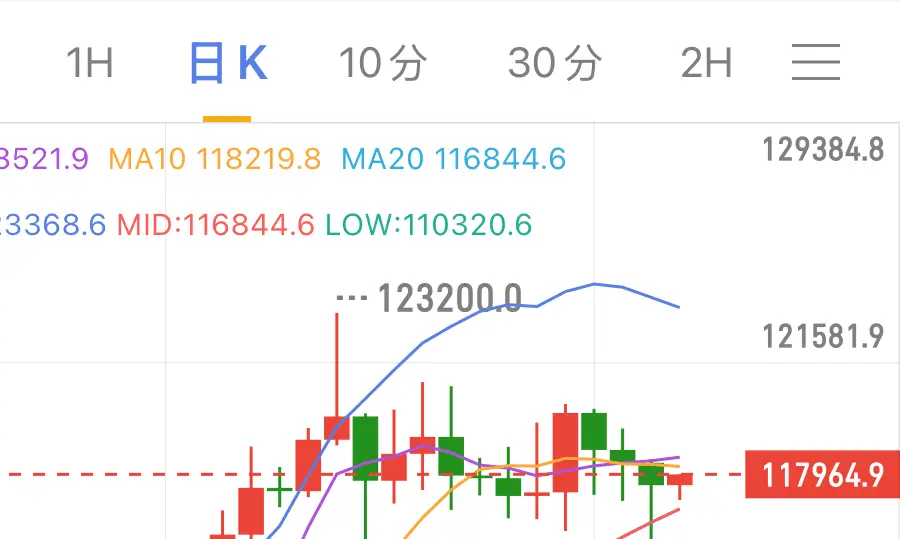

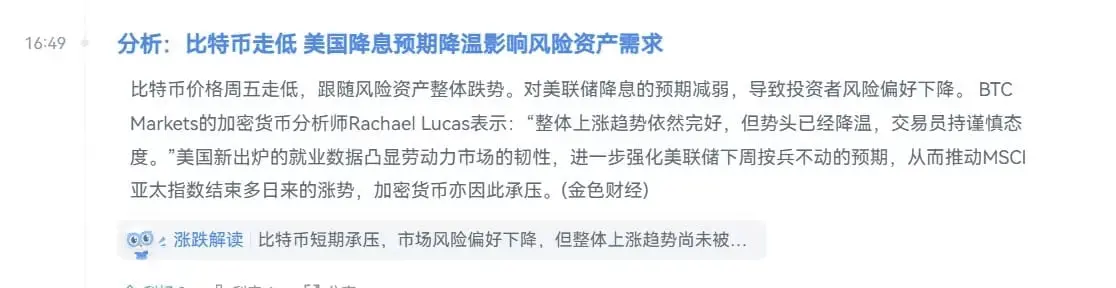

The 90-day buffer period has not only provided valuable breathing space for the global market but has also created a rare rebound opportunity for risk assets. This move is akin to injecting a dose of adrenaline into the market, leading to an overall improvement in macroeconomic sentiment. Major indices such as the Nasd

View OriginalThe 90-day buffer period has not only provided valuable breathing space for the global market but has also created a rare rebound opportunity for risk assets. This move is akin to injecting a dose of adrenaline into the market, leading to an overall improvement in macroeconomic sentiment. Major indices such as the Nasd