Plume Coin Price: Can the Market Overcome Unlock Pressure and Rebound?

Supply and Demand Imbalance: Unlocking Is the Key Test

As of press time, more than 70% of PLUME tokens remain locked. The main focus for the market is the scheduled release of 108 million PLUME tokens on August 21. If market demand is insufficient to absorb this new supply, short-term prices may face even greater downward pressure. This concern has played a major role in the recent decline in investor confidence and the drop in the number of token-holding addresses.

Investor Sentiment: Contradictions and Cautious Waiting

Community feedback and on-chain metrics show that TVL has surged from $25,000 in April to $254 million, indicating that the ecosystem is gradually being adopted. However, token prices have not kept pace with this growth. This disconnect between user activity and token price has heightened uncertainty in the market. Some investors are buying the dip, speculating on the project’s long-term potential, while others—concerned about token unlock pressure and macro market volatility—are becoming more conservative or even cutting losses early.

Technical Outlook: Early Signs of a Reversal?

Although short-term price action remains weak, there are still notable technical factors.

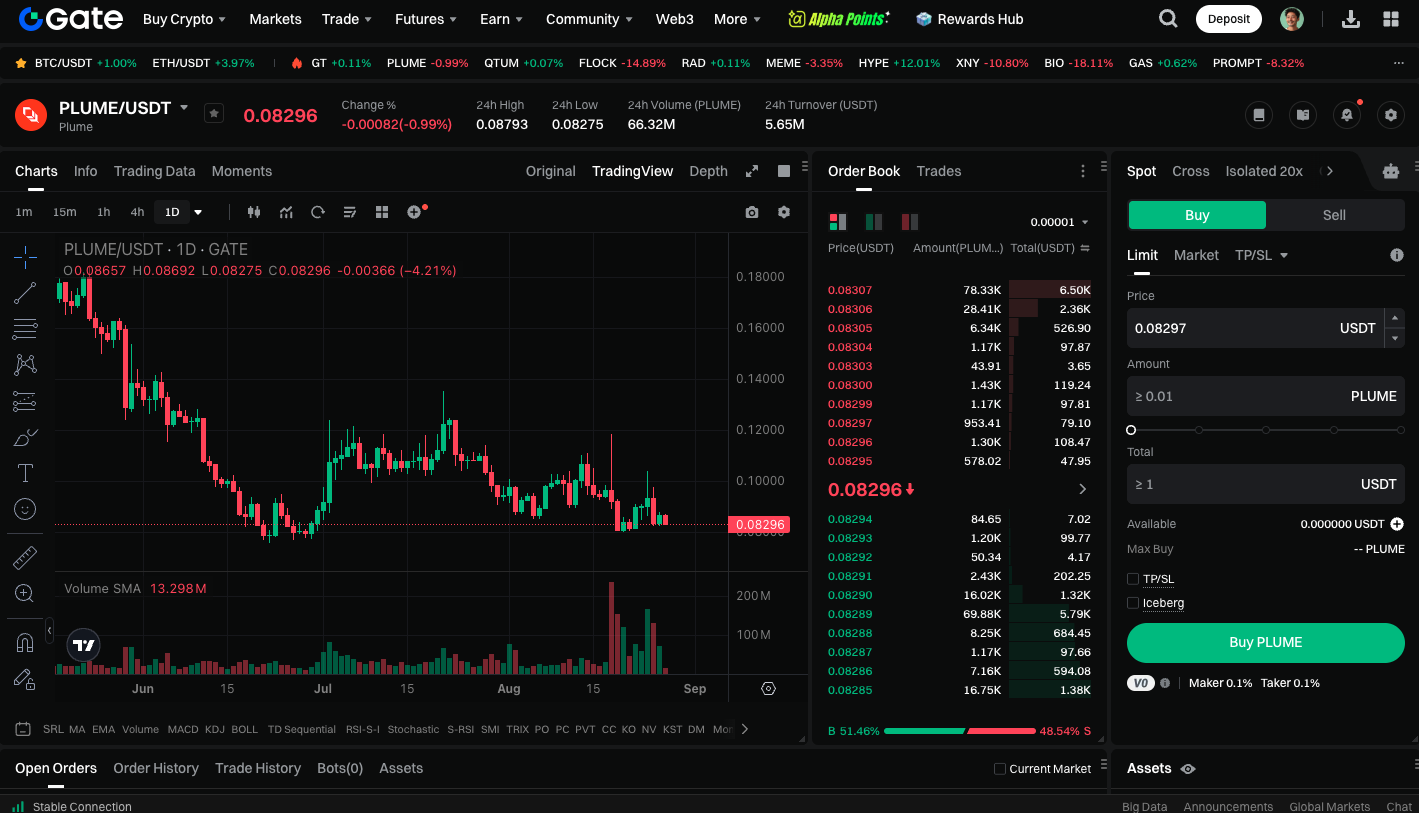

- Support Zone: Buying support persists near the $0.08 level.

- Rebound Target: If the price holds in this zone, it could challenge $0.097 by the end of August.

- Long-Term Potential: Should the project continue advancing asset tokenization, analysts see the price returning to the $0.19 range by 2026.

However, if the price stays below $0.08 for an extended period, it could trigger another round of panic selling.

Key to the Future: Adoption and Supply Management

PLUME’s value proposition is rooted in its ability to bring traditional financial assets onto the blockchain. Developing a low-cost solution for asset tokenization would give it sustainable competitiveness. In the short term, the project must maintain a careful balance between new token supply and market demand, or risk continued downward price pressure.

Trade PLUME spot instantly: https://www.gate.com/trade/PLUME_USDT

Summary

PLUME’s price swings highlight both the high risk of the crypto market and the growth potential of new projects. The upcoming unlocks in the next few weeks will be a critical period to watch. If PLUME can maintain crucial support and spur more real-world adoption, it may find a path to rebound from current lows. If confidence weakens further, however, sustained price declines may be unavoidable.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

What is N2: An AI-Driven Layer 2 Solution

How to Sell Pi Coin: A Beginner's Guide

Grok AI, GrokCoin & Grok: the Hype and Reality

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025